Transform Your Finances: Leading Tips for Effective Car Loan Refinance

Reliable lending refinancing can work as a pivotal technique in changing your monetary landscape. By understanding the subtleties of your present lendings and examining your debt rating, you can position on your own to protect a lot more beneficial terms. With a wide variety of re-financing alternatives offered, it comes to be important to conduct comprehensive research and compute possible savings thoroughly. Nonetheless, numerous forget critical documents that can considerably influence the result of this procedure. As we check out these fundamental steps, you might find that the path to economic enhancement is more accessible than you expected.

Understand Your Present Finances

Before getting started on the finance refinance trip, it is vital to perform a comprehensive assessment of your current finances. Recognizing the specifics of your existing car loans, including rate of interest, terms, and impressive equilibriums, is essential for making notified decisions. Begin by assembling a full list of your financings, keeping in mind the kind-- be it a mortgage, auto funding, or student finance-- as well as the lender details.

Pay special interest to the rate of interest related to each lending. High-interest fundings can benefit dramatically from refinancing, as safeguarding a reduced price can bring about considerable cost savings gradually. Additionally, consider the terms of your lendings; those with longer repayment periods may have reduced month-to-month settlements yet can build up more passion gradually.

It is additionally essential to understand any kind of prepayment penalties or fees connected with your present loans. These costs can affect the total advantages of refinancing. By meticulously assessing your existing car loans, you can figure out whether refinancing lines up with your economic purposes and establish a clear technique for relocating onward in the refinancing process. This fundamental understanding will empower you to make even more strategic and valuable financial decisions.

Evaluate Your Credit History

A solid understanding of your credit report rating is vital when considering loan refinancing, as it dramatically affects the rate of interest and terms lending institutions agree to provide. Credit rating usually vary from 300 to 850, with higher scores showing better credit reliability. Prior to initiating the refinancing procedure, it is crucial to assess your credit history record for any inaccuracies that can negatively influence your rating.

If your rating is below the ideal variety (usually thought about to be 700 or over), think about taking steps to boost it prior to applying for refinancing. This might include paying for existing financial obligation, making prompt settlements, or challenging any mistakes. A higher credit report can result in more desirable refinancing terms, ultimately saving you cash in the long run.

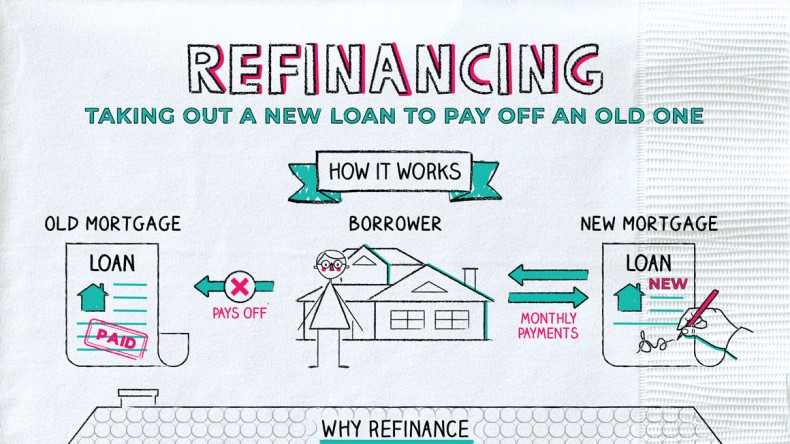

Study Refinance Options

Discovering numerous refinance choices is important for safeguarding the ideal possible terms for your lending. Each option offers distinct purposes, whether you intend to lower your interest price, access equity, or simplify your existing loan terms.

Following, determine potential lending institutions, consisting of standard financial institutions, cooperative credit union, and on-line home loan firms. Study their Resources offerings, rates of interest, and fees, as these can differ considerably. It is critical to read client testimonials and inspect their track record with governing bodies to gauge reliability and customer support.

Furthermore, think about the financing terms used by various lending institutions, consisting of the length of the loan, taken care of vs. adjustable prices, and linked closing costs. Collecting this info will equip you to check my source make enlightened decisions and bargain better terms.

Lastly, be conscious of current market patterns and economic indicators, as they can affect rate of interest. By thoroughly looking into refinance choices, you place yourself to enhance your monetary end results and accomplish your refinancing goals effectively.

Calculate Prospective Savings

Computing prospective savings is a crucial action in the refinancing procedure, allowing consumers to examine whether the advantages outweigh the costs. To begin, recognize your current finance terms, consisting of rates of interest, regular monthly settlement, and continuing to be equilibrium. Next, get quotes for brand-new financing terms from different lenders to contrast interest prices and linked charges.

Once you have this info, utilize a finance calculator to approximate your new month-to-month payment based upon the recommended rates of interest and finance amount. Deduct this number from your current month-to-month settlement to identify your prospective financial savings per month.

Don't neglect to consider any type of closing costs connected with refinancing, as these can considerably impact your total savings. By completely computing both regular monthly and lasting cost savings, you can make an informed choice on whether refinancing is a financially beneficial step for your scenario.

Prepare Essential Documentation

Having examined possible cost savings, the following action in the refinancing procedure involves gathering the necessary paperwork to help with a smooth application. A well-organized collection of papers not only speeds up the authorization procedure however likewise improves your reputation as a customer.

Begin by compiling your financial documents. This includes current pay stubs, W-2 types, and income tax return for the previous 2 years. Lenders will certainly need proof of revenue to examine your capability to repay the financing. Additionally, collect your financial institution declarations and any kind of financial investment account info, as they supply understanding right into your financial health and wellness.

Last but not least, be ready to offer identification documents, such as a driver's certificate or copyright. Detailed preparation of these materials can dramatically enhance the refinancing process, making it much more effective and less difficult for you.

Conclusion

Finally, effective financing refinancing requires an extensive strategy that consists of comprehending informative post existing loans, reviewing credit reliability, checking out various refinancing choices, and determining possible financial savings. Furthermore, the prep work of appropriate documents is crucial for a smooth refinancing process. By complying with these guidelines, individuals can enhance their financial scenario and achieve favorable funding terms, eventually leading to significant savings and boosted monetary security. Careful consideration and calculated planning are extremely important to effective loan refinancing ventures.